Budget 2025 may have sparked some concern amongst kiwis regarding their KiwiSaver.

You may be wondering what is happening with the new rules around higher contributions, lower government top-ups, and help for high earners being cut… Here’s what’s really going on, and why KiwiSaver may still be your best long-term investment.

| Change | Before | From 1 July 2025 |

| Minimum employee contribution | 3% of gross salary/wages | Rising gradually to 4% by 2028 |

| Employer contributions | 3% minimum (before ESCT) | Increasing to 4% (by 2028, before ESCT) |

| Government contribution (MTC) | $0.50 per $1 (max $521/year) | $0.25 per $1 (max $261/year) |

| High-income earners ($180k+) | Eligible for MTC | No longer eligible for MTC |

| 16–17-year-olds | No MTC or employer contributions | Eligible for MTC from 2025, employer from 2026 |

Before:

From July 2025:

Example:

A 17-year-old contributing a minimum of $1,042 per year could receive ~$261 from the government and a close to match from their employer annually, a powerful head start they previously did not have access to.

Over time, even small early regular contributions can make a difference, by compounding into significant long-term savings, potentially even ~$100,000 over 30 years!

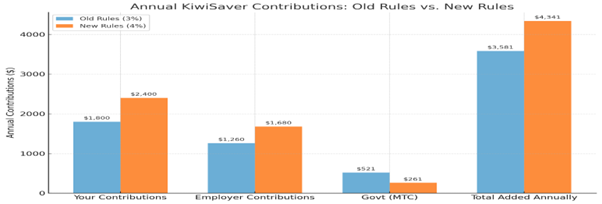

The annual government top-up is reducing from $521 to ~$261. Although it’s $260/year less in support, it’s not the full picture! Because you and your employer will be putting in more, your total KiwiSaver contributions will still increase.

Let’s break it down for someone earning $60,000/year as an example:

Before:

After (from 2028):

So, that’s an extra ~$760/year added to your KiwiSaver, even with a lower government top-up.

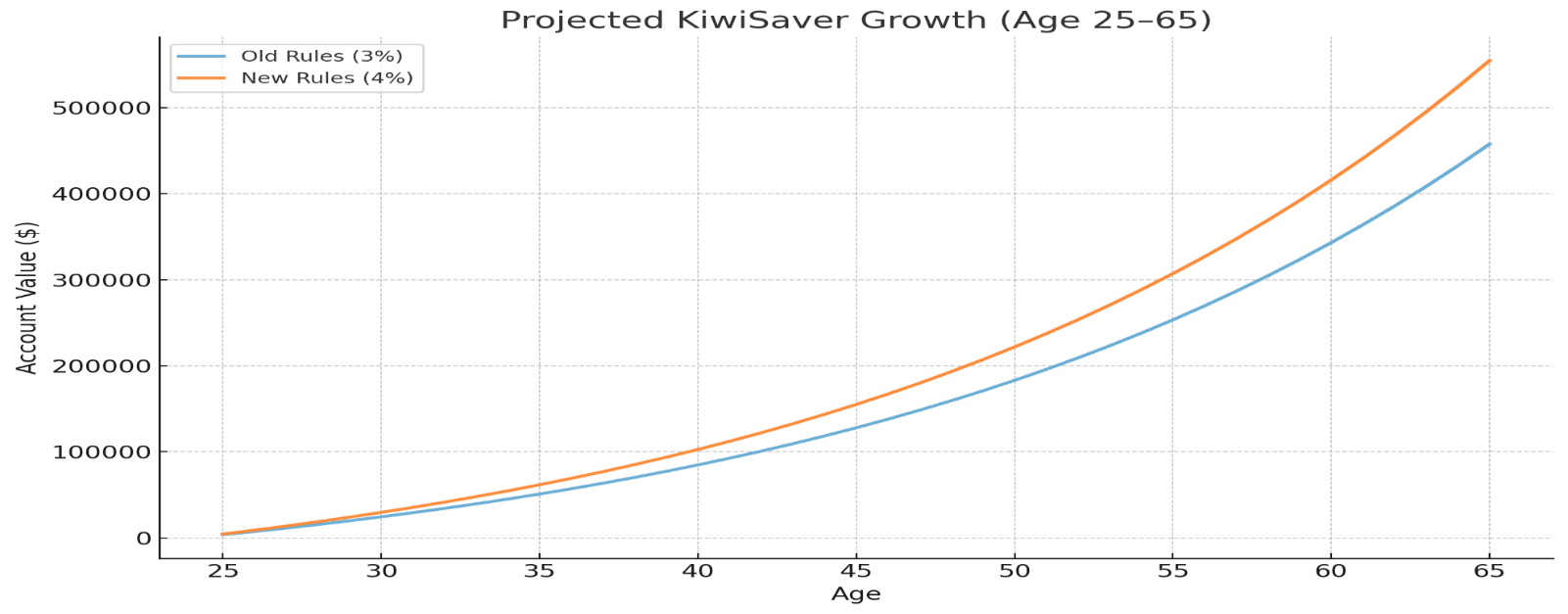

Value at Retirement (Age 65)

| Scenario | Your Contributions | Estimated Value @ 65 |

| Old Rules | $72,000 | ~$471,000 |

| New Rules | $96,000 | ~$571,000 |

*Assumptions in disclaimer

Even with a halved government top-up, you could finish $100K better off in retirement under the new rules, simply because more money was contributed.

That additional $100,000 at retirement could give you:

That’s potentially money for a holiday, to leave a legacy for your kids, cover future health costs, create a safety buffer, enjoy a comfortable retirement, or simply have more choices in life!

Even without the government contribution, KiwiSaver still holds major value:

If you’re a high-income earner, KiwiSaver may not be your only retirement savings tool, but it’s still one of the most efficient places for long-term compounding.

Although halving the government contribution may feel like a step back, the bigger picture shows KiwiSaver being rebalanced:

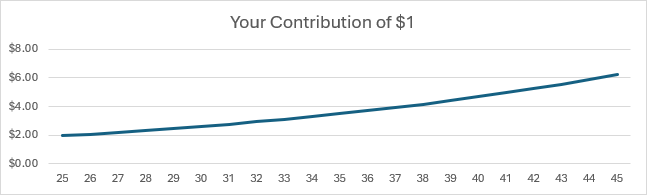

KiwiSaver remains one of the easiest ways to turn your $1 into many multiples more over time, with help from your employer, government, and compounding interest.

Even with less government support, your contributions and time in the market still make KiwiSaver a powerful tool to utilise. Be patient, stay the course, and your future self will thank you for it!

Looking to review your KiwiSaver? Speak to an adviser today to find out how you can make the most of your contributions.

Important disclaimer:

The projections and scenarios provided are for illustrative purposes only. They are based on assumptions that may not reflect actual outcomes. Past performance is not indicative of future returns. Please consult a licensed financial adviser for personalised advice.

Assumptions: We’ve based this projection on a 25-year-old earning $60,000 annually, contributing 4% to KiwiSaver in a high growth fund, with regular contributions and a 6% annual return (before fees and taxes), the model assumes retirement at 65 and drawing income until age 90.

Fill out the form below and one of our KiwiSaver experts will call you within 24 hours.

"*" indicates required fields