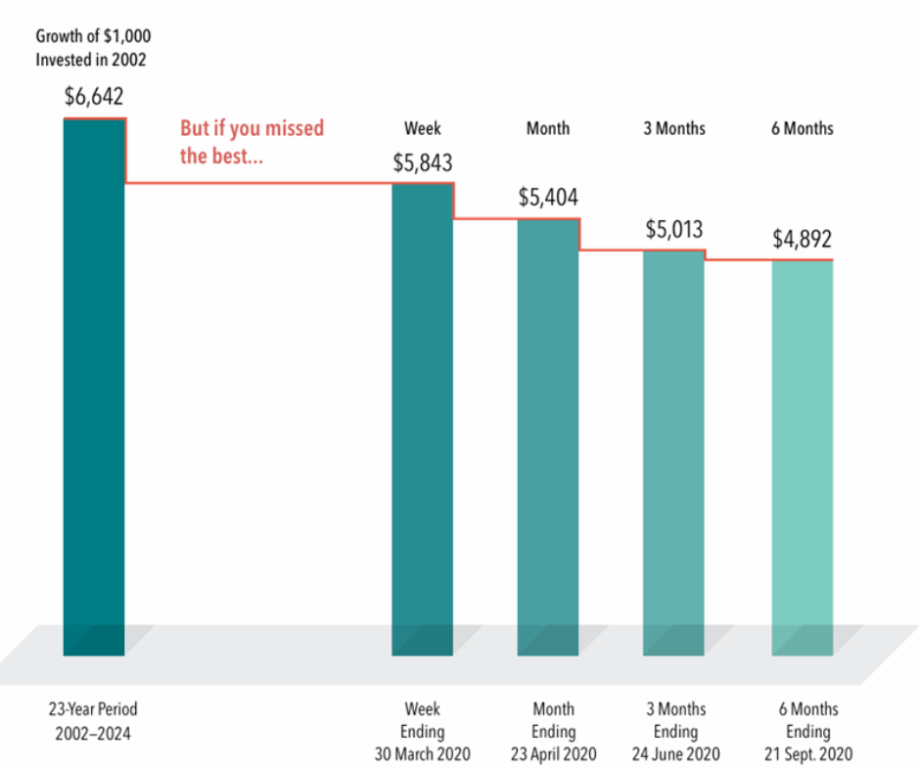

The reality of market timing

The problem is simple: there’s no proven way to consistently predict when those “best days” will happen. They often occur during periods of high uncertainty – exactly when many investors are most likely to exit the market.

The smarter approach

Rather than trying to jump in and out, staying invested allows you to capture the full potential of the market over time. Consistency and patience often matter more than timing.

The takeaway

Trying to time the market isn’t just difficult – it’s costly. A disciplined, long-term investment strategy keeps you in position to benefit from the market’s growth.

Reference: Data adapted from Dimensional Fund Advisors.

Please fill in the form below with your contact details and one of our advisers will get in touch in 24 hours.

"*" indicates required fields