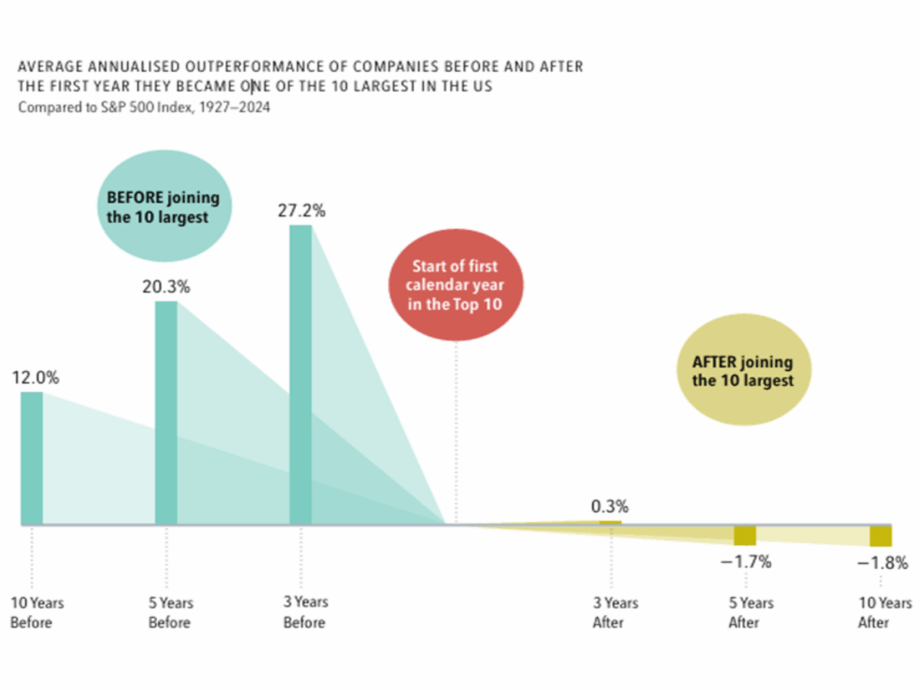

From 1927–2024, companies entering the Top 10 by market value followed a striking pattern:

Why does this happen?

By the time a company becomes one of the biggest in the world, much of the good news is already reflected in its share price. While new information can still move prices, these shifts are unpredictable and difficult to profit from consistently.

What it means for investors

Chasing the latest “winner” can backfire. A portfolio concentrated in the largest names risks missing opportunities elsewhere, and can become vulnerable if those giants stumble.

The takeaway

Past success doesn’t guarantee future outperformance. A well-diversified, disciplined approach that looks beyond today’s biggest companies gives investors a stronger foundation for long-term returns. If you’d like to explore how this applies to your own situation, complete the form below to connect with an Apex Advice investment adviser for tailored investment guidance.

Reference: Data adapted from Dimensional Fund Advisors.

Please fill in the form below with your contact details and one of our advisers will get in touch in 24 hours.

"*" indicates required fields