Term deposits (TDs) are a popular choice for people who want a safe and steady way to protect and grow their money. But with interest rates on the decline, there’s something important to keep in mind: reinvestment risk. Let’s break down what this means.

What the data shows

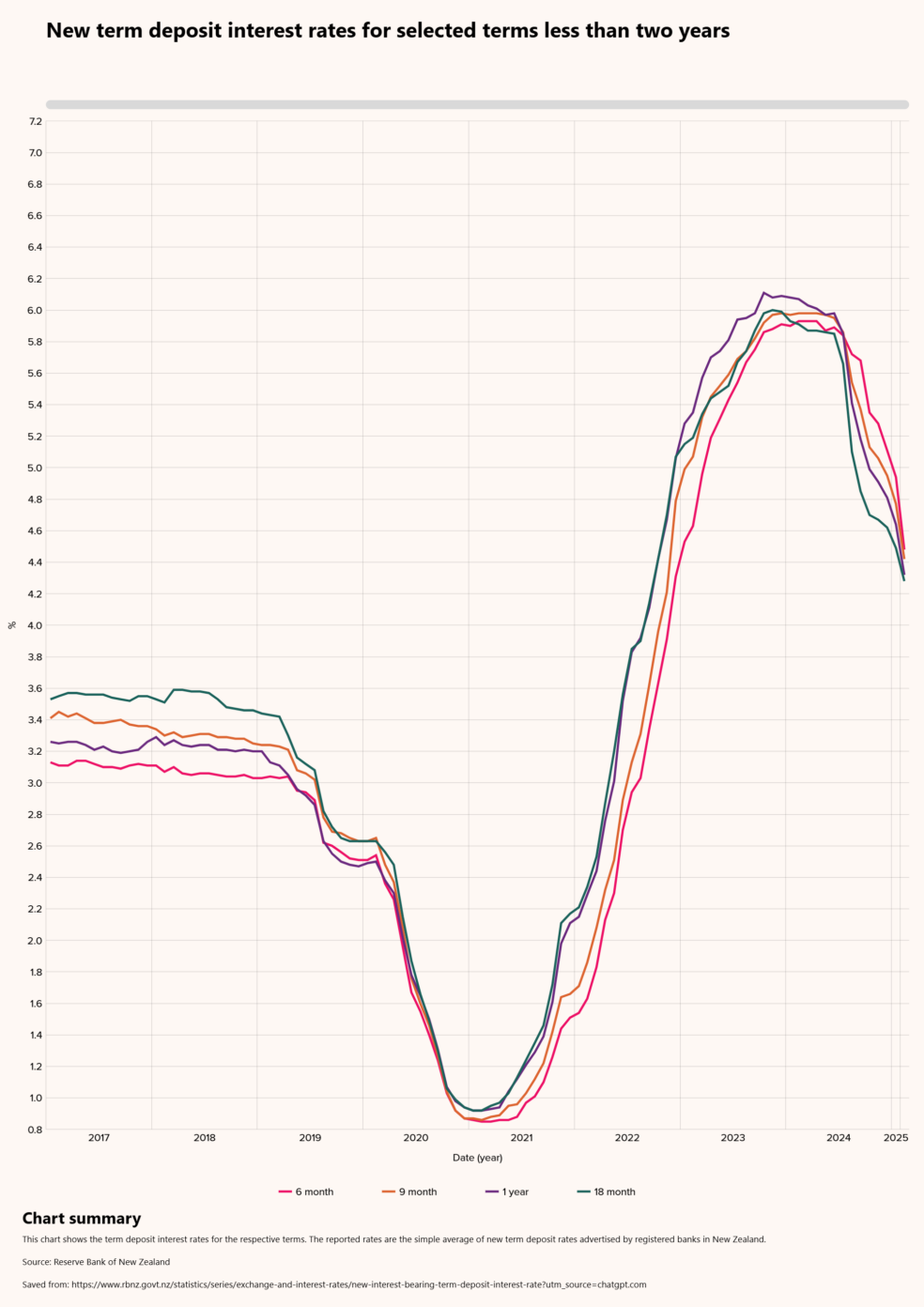

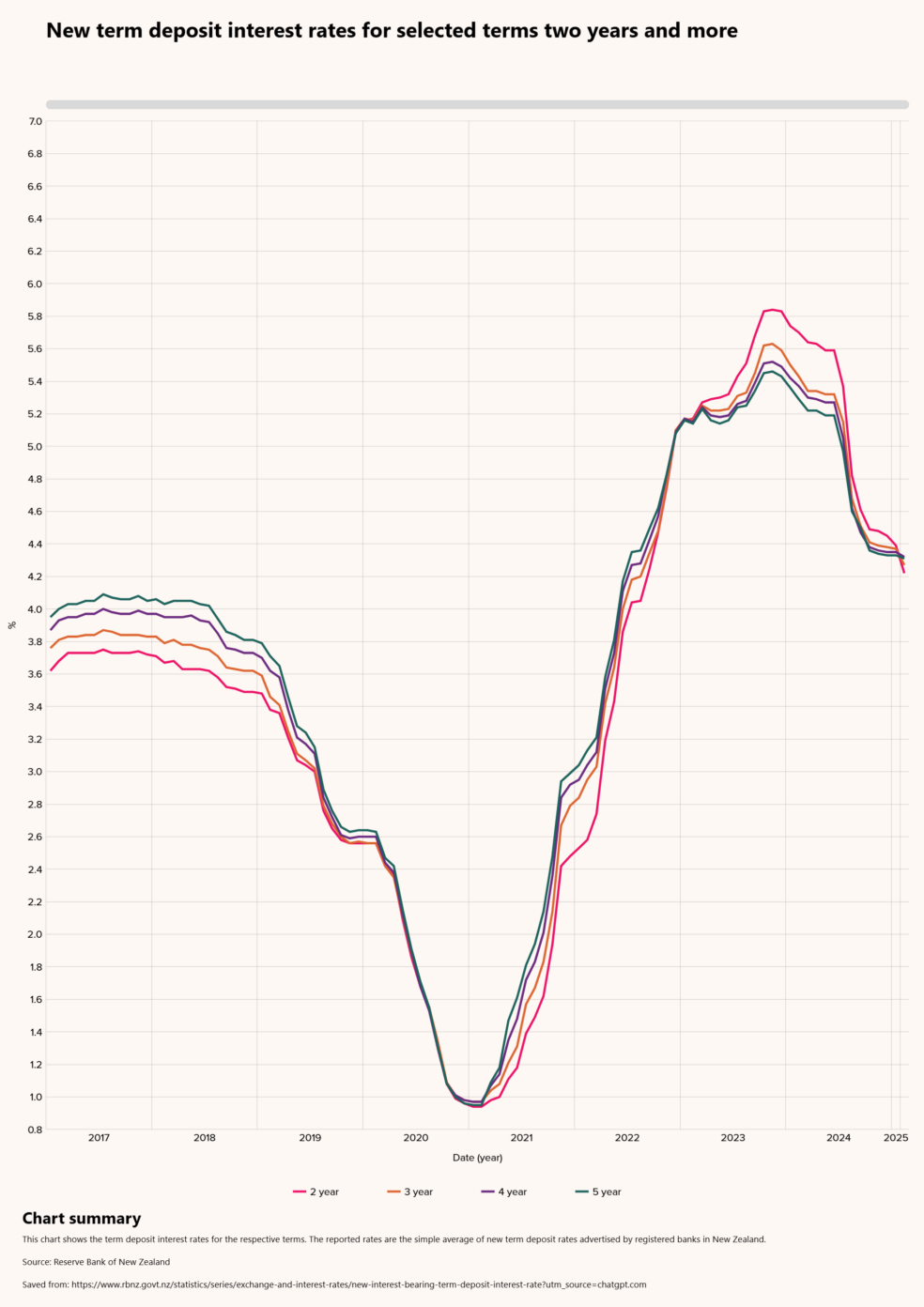

Recent figures from the Reserve Bank of New Zealand (RBNZ) illustrate this trend below. The data tracks the interest rates offered by banks in New Zealand on term deposit savings accounts over time, and it shows a steady softening in rates, particularly for longer-term deposits.

Understanding Reinvestment Risk – Example:

Let’s say you invested $50,000 in a 1-year TD at 6% last year. When it matures:

That’s $1,000 less annual earnings on the same investment – the concrete impact of reinvestment risk.

Note: This is an illustrative example – actual rates vary by institution and market conditions.

Why does the OCR matter?

Here’s the simple part: the OCR is the rate at which the Reserve Bank lends to banks. When the OCR goes down, banks typically follow suit and lower the interest rates they offer on things like term deposits. So, when your TD matures, the rate you’re offered could be lower, which means your returns might not be as good as what you’ve been getting.

How does this affect your savings?

If you’ve got a term deposit coming up to maturity, you might find yourself facing a tricky situation: reinvest your money at a lower interest rate or explore other options. This won’t affect your current deposit, but it’s something worth thinking about for the future.

Reinvestment options: speak to an expert

If you’re not sure what to do when your term deposit matures, it might be time to have a chat with a financial adviser. They can help you figure out the best options for reinvesting your money – whether it’s in another term deposit or something different. A good adviser will make sure your money is working in the right way for you, even when rates are falling.

The bottom line

Falling interest rates mean lower returns for new term deposits. If you’re planning to reinvest your money, expect the possibility of lower rates. Keep an eye on the OCR, but don’t hesitate to speak with a financial adviser to make sure you’re making the right choices for your savings. It’s all about finding the right strategy to keep your money growing.

(Disclaimer: This content is for general information only. Please consult a financial adviser for personal advice.)

Please provide your contact details in the form below and one of our financial experts will call you within 24 hours. "*" indicates required fieldsHow can we help you today?