One of the most powerful tools in investing is compounding. It sounds technical but it’s actually very simple. It just means you earn returns on both your original investment and on the returns that money has already made. Over time this can make a big difference.

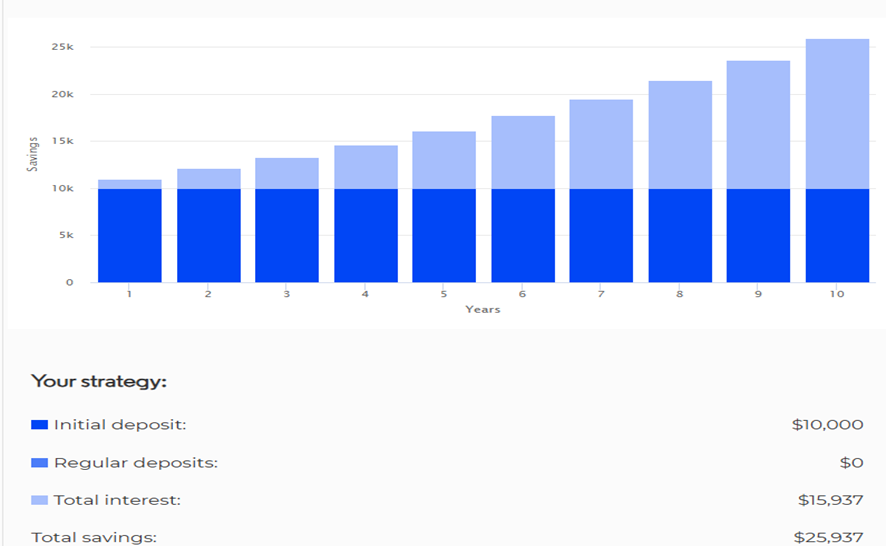

Let’s look at an example:

You start with $10,000. You earn 10 percent a year after fees and tax. At the end of year one you have $11,000. That’s $1,000 in returns.

In year two your 10 percent is now calculated on $11,000 not just your original $10,000. So, you earn $1,100. Your total investment is now worth $12,100.

It keeps going from there. In year three you’re earning 10 percent on $12,100. That’s $1,210. Your investment is now $13,310. Every year your returns get bigger, not because you put more money in but because your money is working harder.

A quote often attributed to Einstein (though the source is debated) goes like this:

“Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.”

After ten years that $10,000 would grow to $25,937. In that tenth year alone, the returns would be $2,358. Compare that to $1,000 in year one. All you did was stay invested and let time do the work.

Source: https://moneysmart.gov.au/

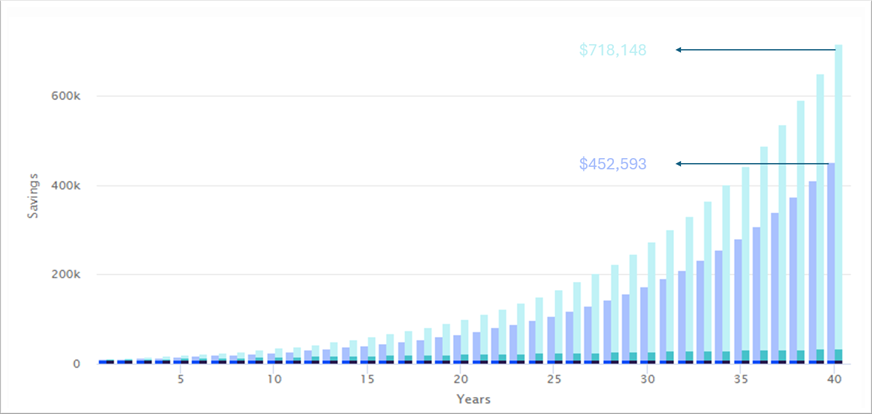

Now imagine what happens if you stay invested for 40 years without adding a cent more. That original $10,000, growing at 10 percent a year, would grow to about $452,593. Your money has grown more than 45 times, just by letting it work quietly over a long time.

Warren Buffett, one of the world’s most successful investors, once said, “My wealth has come from a combination of living in America, some lucky genes, and compound interest.” (Source: Warren Buffett, Fortune Magazine, 1995)

Compounding is not about chasing high returns or reacting to every market move. It’s about being patient and staying the course. The longer your money stays invested the more time compounding must work its magic.

As Morgan Housel, author of The Psychology of Money, puts it,

“Good investing isn’t necessarily about making good decisions. It’s about consistently not screwing up and letting compounding do its job.” (Source: The Psychology of Money, Morgan Housel, 2020).

So, if you’re thinking about investing, remember starting early and staying in can be more powerful than picking the perfect time.

(Dark Blue): A $10,000 initial investment, with a 10% p.a. return every year, and the returns are reinvested, over a 40-year time horizon. (Compounding)

(Light Blue): A $10,000 initial investment, plus a $50 deposit every month, with a 10% p.a. return every year, and the returns are reinvested, over a 40-year time horizon. (Compounding Plus)

Source: https://moneysmart.gov.au/

Ready to make confident moves with your money?

Our specialised team of advisers is here to help you crunch the numbers and review your investments. Simply schedule a time through the button below to chat with an adviser – your future self may thank you for it!

Disclaimer and Assumptions: