Are you on track for the retirement you deserve?

Most people aren’t, and waiting could cost you thousands. Whether you’re just starting your career, advancing professionally, or nearing retirement, planning is critical to securing your financial future.

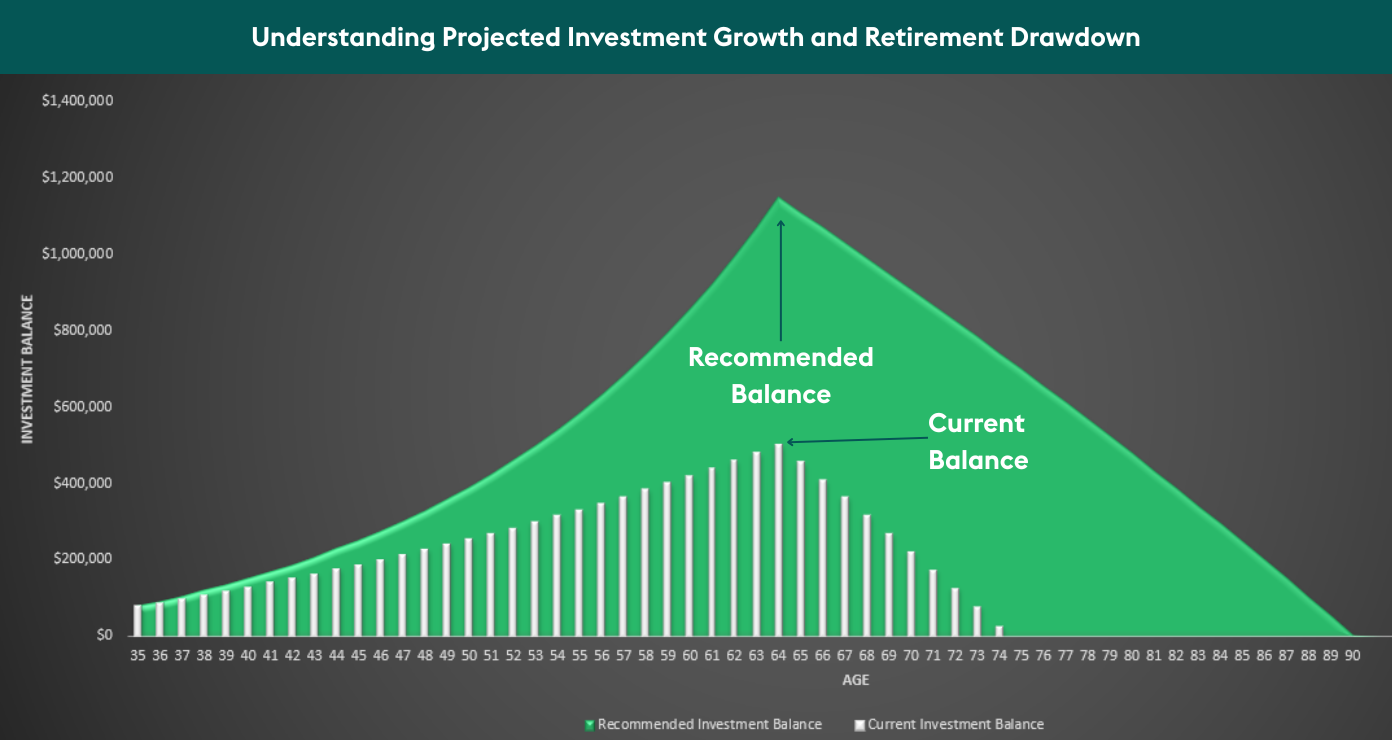

The graph above shows the difference between current investment balance and the recommended investment balance for a secure retirement.*

If your investment looks more like the white bars instead of the green curve, you risk falling short in retirement.

The good news is, there’s still time to make changes. The sooner you act, the better your future will look.

Our investment advisers will help you create a strategy to close the gap and build wealth for retirement.

A 30-minute consultation could change your future.

Client Testimonials

“Matthew is courteous and knowledgeable in the way he offers his opinion on the financial market. He cares about people and how to plan for the future bearing in mind the individual situation.”

– A.H. January 2025

“Very happy having Mike as my financial adviser (for the past few years) and enjoyed a zoom meeting with him today. Mike is very open re my investments, explains all aspects of the investments and our discussions are informative and I am aware that the markets in the year ahead could be volatile or not, but having Mike at the helm confident my investments are in good hands.”

– M.K. January 2025

“I have been a loyal customer for the past 12 years because the service I get from you guys is exceptional. All my dealings with the team are fantastic, so well done and keep it up.”

– M.V February 2025

*Disclaimers: This projection is based on assumptions and is for illustration purposes only.

*Assumptions are that the investment is expected to grow steadily until retirement, after which withdrawals will gradually reduce the balance.

The analysis is based on the following assumptions: an inflation rate of 2%, a retirement age of 65, and a post-retirement return of 3%. The investor starts at age 35 with an initial balance of $80,000 and contributes $7,000 annually. The current pre-retirement return is projected at 5%. To ensure financial security, a recommended balance of $80,000 is advised, along with an annual contribution of $7,000 and a recommended pre-retirement return target of 9%. The planned annual withdrawal post-retirement is $50,000.

Please fill in the form below with your contact details and one of our advisers will get in touch in 24 hours. "*" indicates required fieldsWherever you are on your investment journey, we can help.

Embrace a holistic view of your financial wellbeing.

From insurance to mortgages to KiwiSaver and investments, we can help you balance these moving parts through our protect, own, grow philosophy.